The Signal That Predicted This Tech Giants 1

Bet on the right tech companies and management teams with information, not opinion.

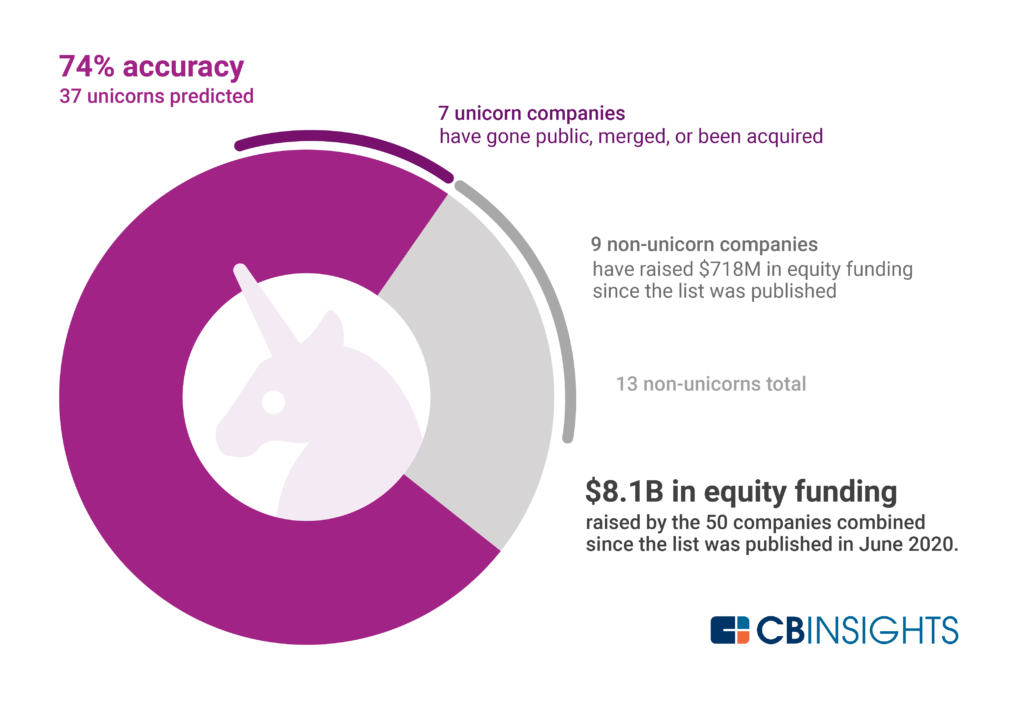

In 2015, nosotros worked with The New York Times to predict 50 future unicorns (companies that would eventually exist valued at $1B or more). To engagement, 31 of them have hitting that mark (62%).

Nosotros tried again in 2019, and in just 2 years since, 58% of those have made information technology to unicorn status — an even improve unicorn prediction pace.

In 2020, we partnered with Fast Company for our most recent round of 50 unicorn predictions.

In under a year and a one-half, 37 of the companies have striking unicorn condition (74%).

If nosotros were a venture capital firm, that kind of hit rate would make us legendary.

Our secret weapon has been Mosaic — a serial of proprietary algorithms we've been developing for the better part of a decade with initial support from the National Scientific discipline Foundation.

What is Mosaic?

In 2010, we approached the National Scientific discipline Foundation with the idea that we could apply publicly available information and not-traditional signals to assess the wellness and likelihood of future success of private tech companies.

After receiving iii grants from the NSF, we worked toward a model dubbed Mosaic that would aggregate and synthesize data nigh these companies from disparate sources and brand understanding and identifying the best tech startups less of a crapshoot. Think of Mosaic in part equally a FICO score for private tech startups.

If we could exercise this with Mosaic, nosotros could arm firms buying or investing in technology with superpowers for finding and predicting tech company success while their competitors hunted for the right companies in the dark.

So how does Mosaic work?

The 4 Ms of Mosaic

The Mosaic overall score comprises 4 individual models — what we call the four Ms.

- Momentum — how much traction does the visitor have?

- Market place — how healthy is the industry the visitor is in?

- Money — what is the financial wellness of the visitor?

- Management — who are the leaders of the visitor?

Each M relies on different signals.

Below is a flake on each model (although all the signals utilized are not revealed, for obvious reasons).

Momentum

We capture many volume and frequency signals including news/media, sentiment, partnership & customer momentum, and social media, among other signals.

We look at these on an absolute and relative basis vs. peers/manufacture comparables. The relative piece is disquisitional as it ensures that, for case, enterprise software companies that may go less media attention or that spend less fourth dimension on social media are not penalized vs. consumer-focused tech companies.

Market

The quality of the marketplace or industry a company competes in is critical. If you lot are part of an industry which is in favor, that serves every bit a tailwind to push you along. Conversely, existence in an out-of-favor space means fewer investors, partners, media, and more.

Said another style — you don't want to exist a daily deals visitor today.

The market model looks at the number of companies in an manufacture, the financing and exit momentum in the space, and the overall quality and quantity of investors participating in that area.

Money

The coin model is all well-nigh assessing the financial wellness of a company, i.e., practise nosotros recall it's going to run out of money?

Our model here looks at things including burn charge per unit, the quantity and quality of the investors and syndicate that may exist part of the company, and its financing position relative to manufacture peers & competitors.

Direction

Our most contempo Mosaic model centers effectually the founding and management team at private tech companies.

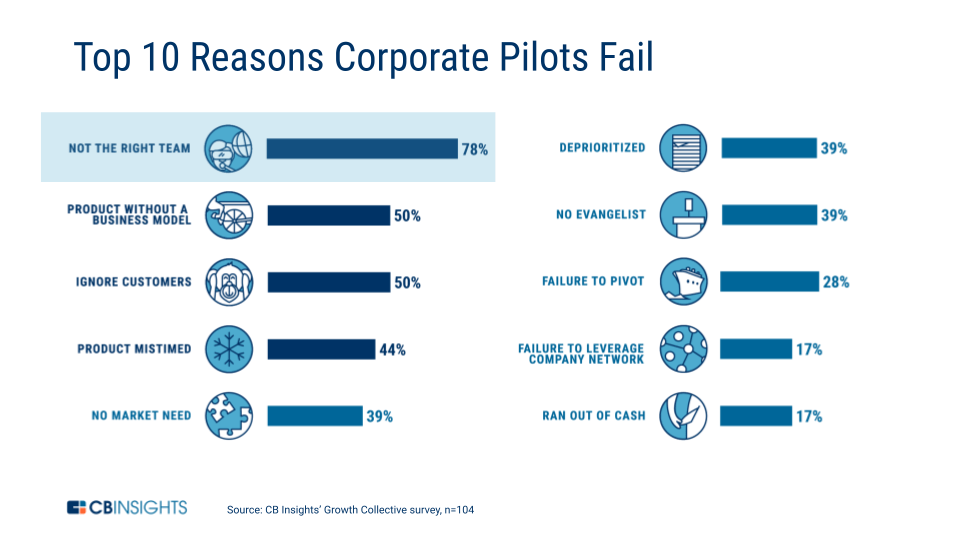

We find that, in selecting investments or partnerships, especially with early-stage tech companies, VCs and corporates identify the greatest importance on the founding and management squad.

In fact, a Harvard Business Review report found that 95% of VC firms cited the management team most frequently as an important gene in their bargain evaluations.

And when asked why corporate pilots neglect, 78% of corporate respondents cited the team, per a 2019 CB Insights customer survey.

Bottom line: Investors care near track tape, or more specifically, the quality of management.

Using the wealth of People Data in our platform, our Direction model looks at founding and management teams' work accomplishments like previous exits, funding rounds, industry experience, equally well as their didactics groundwork and network.

Each of the four Chiliad models is scored on a calibration of 0-one thousand and drives the overall Mosaic score (also on a 1000 point scale, with one thousand being the best score).

How can my team unlock the ability of Mosaic?

Enterprises and investors rely on Mosaic to shortlist and evaluate the right private tech companies.

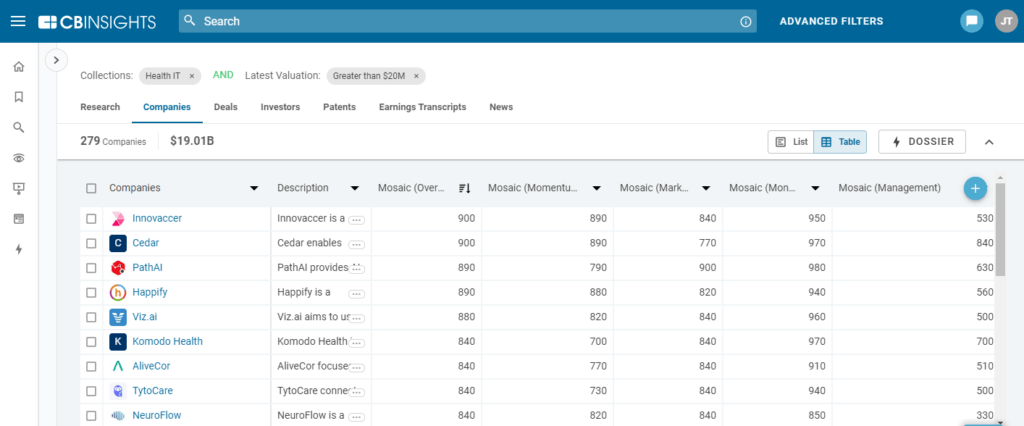

Compare multiple partner, investment, or acquisition targets beyond a broader market

Define your universe — in the case below, health Information technology companies worth $20M+ — and utilize Mosaic as your guiding low-cal to shortlist the tech companies you lot should take on your radar.

Screen individual private tech companies and their management teams

Through a recent customer survey, we constitute that 23% of teams are screening 1,000+ companies per year.

That's a lot.

Running searches across eight different resources to endeavor and piece together a company'due south financial health, founding squad, partnerships, and more isn't a smashing use of fourth dimension.

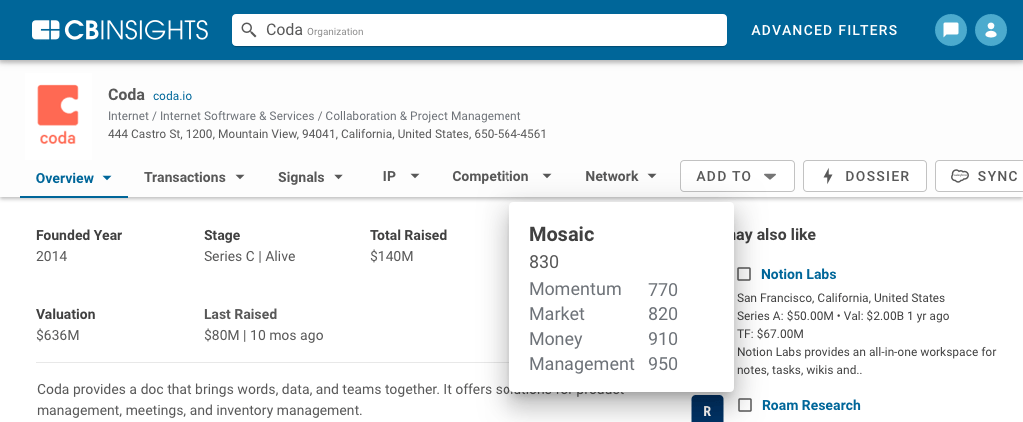

Instead, upon landing on a private tech visitor profile with Mosaic scores, you can instantly glean important key performance indicators like valuation, stage, last raised, network, and more. These all funnel into that company'southward Mosaic scores, as shown beneath for project direction company Coda .

And when you don't take a lot of signals coming from early on-stage tech companies, you've got to bet on and trust the founding team to grow and lead the company to a positive outcome.

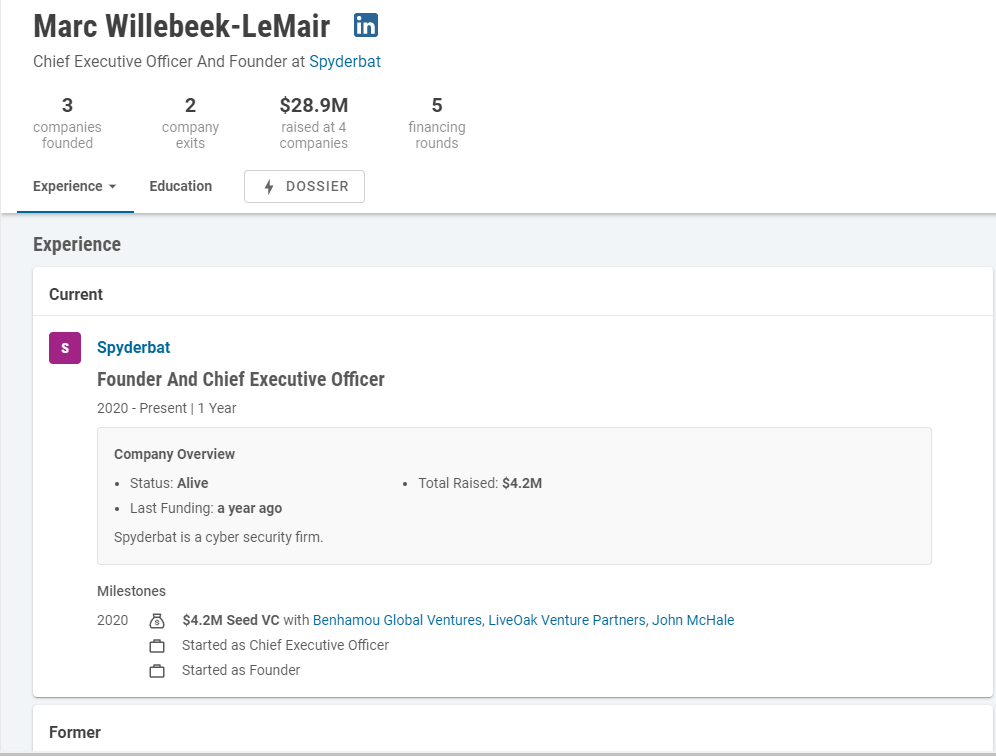

With automobile-generated and interactive Key People visualizations, it'south easy to clarify founders and leaders at any stage, every bit shown below with series entrepreneur Marc Willebeek-LeMair , founder and CEO of cybersecurity company Spyderbat .

What'southward next for Mosaic?

We have two primary areas of focus for Mosaic going forward:

- Gathering more than data from companies themselves — To battle the opacity challenge, nosotros've launched complimentary Analyst Briefing Surveys for tech companies to increase their exposure and pigment the most complete picture of themselves for Mosaic. If y'all'd like to bear a briefing with our analysts, please submit some basic data through this survey (<3 minutes). Our analysts will so review and accomplish out to relevant companies to begin the analyst briefing process.

- Extending to other industries — We believe there are other sectors, such as consumer appurtenances & services and biotech/pharma, that Mosaic tin be extended to. These industries provide unique signals that could feed into the models.

To run across our l unicorn picks with Fast Company and the 74% we got right, download the full report here .

Source: https://www.cbinsights.com/research/team-blog/tech-startup-momentum/

0 Response to "The Signal That Predicted This Tech Giants 1"

Post a Comment